Introduction

Eimskip’s operations are divided into two principal market segments: liner services in the North Atlantic and international forwarding services.

LINER SERVICES

- The core of the Company’s operations

- Eimskip’s home market includes Newfoundland and Labrador, Iceland, the Faroe Islands and Norway

- 22 vessels in operation

- Terminal operations

- Chilled and cold storage facilities

- Warehousing

- Trucking and distribution

- Air freight services

- Agency services

FORWARDING SERVICES

- Main focus on reefer forwarding but dry cargo forwarding is growing

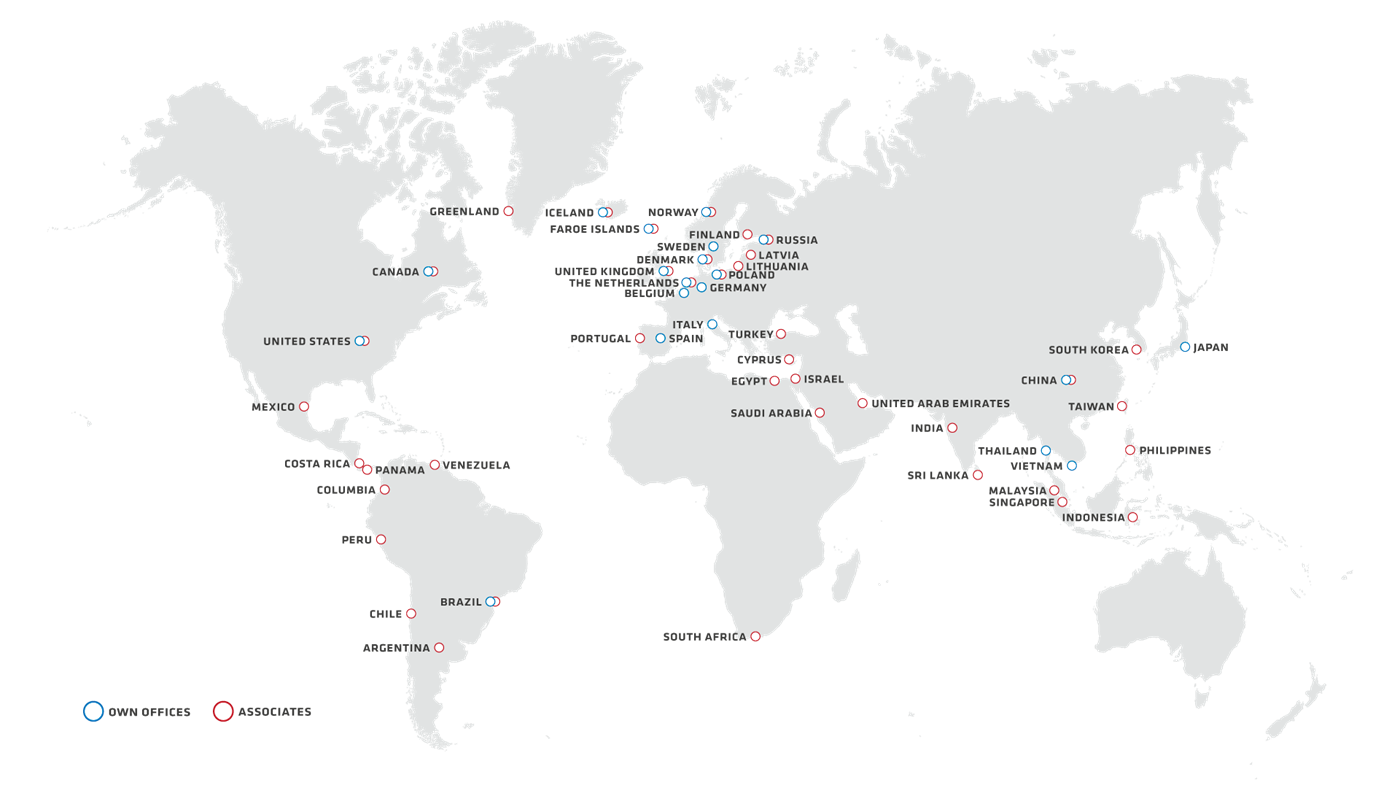

- Efficient system based on a network of 63 own offices in 20 countries in four continents

- Cooperation between Eimskip’s own offices, its worldwide network of associates and international deep-sea lines

One of Eimskip’s Strategic Priorities 2018 is PROACTIVE SALES AND SERVICE APPROACH IN LINER AND FORWARDING, where the focus is on being proactive in sales and services to increase sales in all markets.

In 2017, 66.0% of Eimskip’s revenues came from liner services and 34.0% from forwarding services. The split of EBITDA between segments in 2017 was 69.1% from liner services and 30.9% from forwarding services. Substantial growth in the forwarding services in recent years has been increasing the proportion of asset-light EBITDA and generating higher return on equity. Geographical split of revenue changed in 2017 compared to previous year, mainly due to new Group companies, where Iceland contributed less than half of total revenue and Europe has increased to 24%.

REVENUE BY BUSINESS SEGMENT

EBITDA BY BUSINESS SEGMENT

DEVELOPMENT OF EBITDA BY BUSINESS SEGMENT

EUR million

GEOGRAPHICAL SPLIT OF REVENUE

LINER SERVICES

Eimskip’s liner services are the core of the Company’s operations. The liner services operate a dynamic sailing system in the North Atlantic, currently with 22 vessels in operation. The Company’s home market includes Newfoundland and Labrador, Iceland, the Faroe Islands and Norway. The liner services also offer short-sea services in Europe and North America, Trans-Atlantic services and bulk transport. Liner services include terminal operations, chilled and cold storage facilities, warehousing, trucking and distribution, air freight services and agency services.

KEY STATISTICS

Liner services revenue for the year 2017 amounted to EUR 438.4 million, up by 15.3% from 2016. EBITDA from the liner services was EUR 39.5 million compared to EUR 42.4 million in the previous year. In 2017, liner services accounted for 66.0% of the Company’s revenue and 69.1% of its EBITDA. These ratios decreased compared to the previous year, mainly due to new acquisitions of forwarding companies.

Transported volume in Eimskip’s liner services in 2017 grew by 3.6% from the previous year, mainly due to good growth in imported volume to Iceland and in Trans-Atlantic volumes, while there was some reduction in export volumes from Iceland and the Faroe Islands. Due to the growth in import volume to Iceland, the Company faced increased imbalance in the Icelandic market that caused some operational challenges during the first half of the year. To offset the cost related to the imbalance, the Company implemented a new Container Positioning Charge (CPC) and made various operational adjustments to increase the efficiency of the sailing system.

As shown on the graph below on the left, transported volume in the Company’s liner services has gradually been increasing in recent years. The compound annual growth rate (CAGR) for the years 2013 to 2017 was 5.4%. The volume index on the right axis is based on the 2010 volume as 100. The graph below on the right shows that 68% of the liner services volume relates to Iceland.

LINER SERVICES VOLUME

Changes from previous year

LINER SERVICES VOLUME 2017

Iceland, Faroe Islands, Norway and Trans-Atlantic

HOME MARKET

Eimskip has defined its home market as the North Atlantic, stretching from the east coast of North America to the west and north coasts of Norway and embracing Newfoundland and Labrador, Iceland, the Faroe Islands and Norway. These countries are all niche market areas, rich in natural resources and with small population.

Seafood represents a substantial part of total cargo in the Company’s home market.

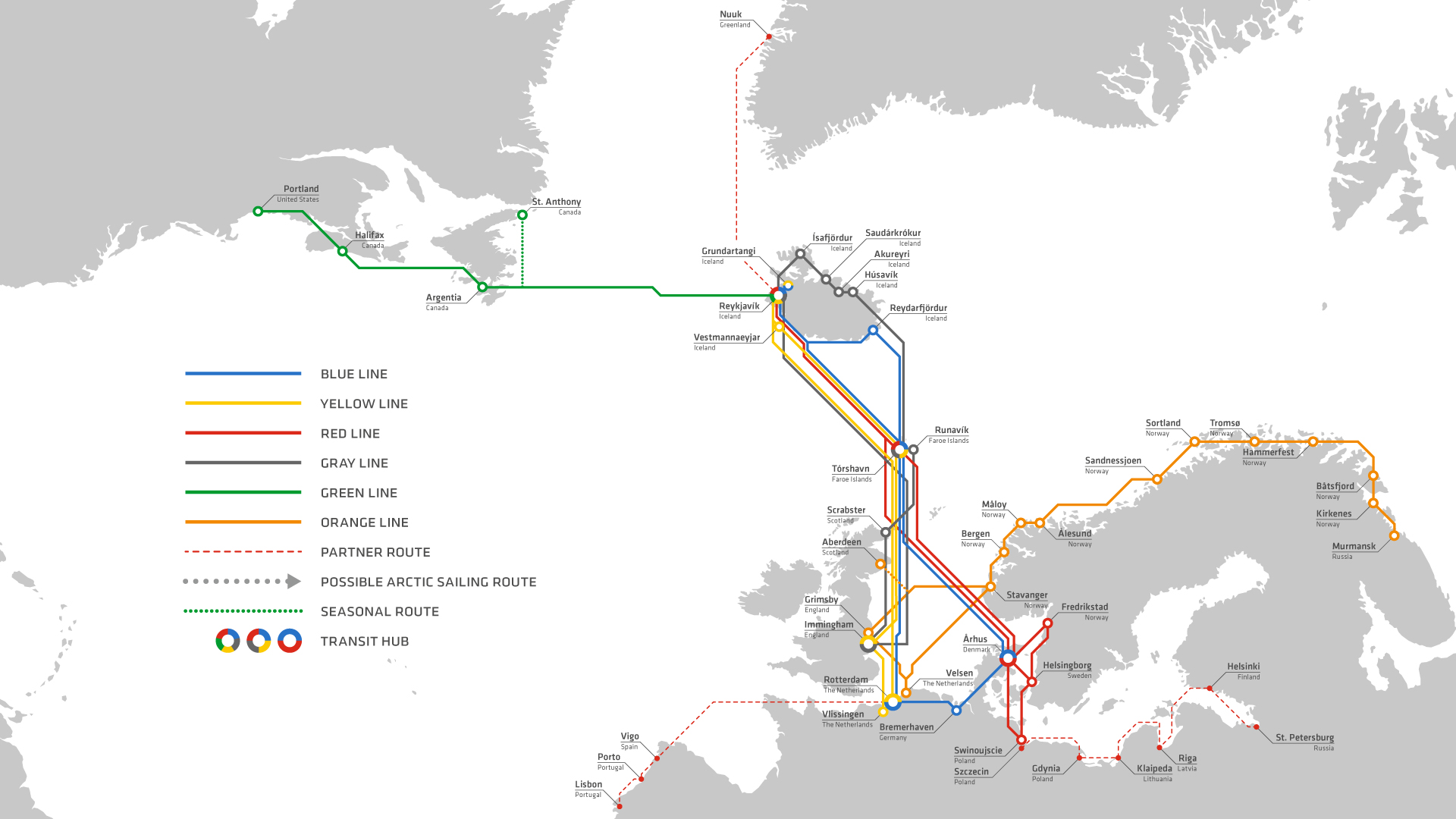

SAILING SYSTEM

Eimskip constantly re-evaluates its sailing system and vessel fleet with the aim of optimizing its operational efficiency. One of the Company’s Strategic Priorities 2018 is STRENGHENING OF SAILING SYSTEM AND INFRASTRUCTURE, where the focus is on optimizing Eimskip’s sailing system and utilization of its vessel fleet, after having achieved the goal of weekly sailings on all the Company’s six sailing routes.

In 2017, Eimskip invested in the future of its container liner services by making changes to its sailing system and has reached its goal of weekly service on all sailing routes. In February 2017, a new Red Line was added to strengthen the services in Scandinavia and changes were made to the services to and from North America on the Green Line. Weekly coastal services were started to support increasing activities in Iceland, served by the Gray Line, which also serves the Faroe Islands and the UK. At the end of November, the Company further increased the sailing system capacity by offering weekly services between Northern Europe and North America with the third vessel on the Green Line. Substantial growth in Trans-Atlantic volumes in recent years and additional volume from Eimskip’s current customers and new customers that rely on weekly services, together with a new short-sea agreement with the international shipping company CMA CGM between Halifax, Nova Scotia and Portland, Maine in the US, supported the weekly services and the additional vessel on the route.

The Blue Line offers weekly services from Iceland to the Faroe Islands, the Netherlands, Germany and Denmark and then back to the Faroe Islands and Iceland. The vessels serving on the Blue Line are the Godafoss and Dettifoss.

The Yellow Line offers weekly services from Iceland to the Faroe Islands, England and the Netherlands and then back to Iceland. The vessels serving on the Yellow Line are the Lagarfoss and Bakkafoss.

The Red Line offers weekly services from Iceland and the Faroe Islands to Denmark, Poland, Norway and Sweden and then back to Iceland. The vessels serving on the Red Line are the Pollux and Perseus.

The Gray Line offers weekly services between Iceland, the Faroe Islands, Scotland and England and then back to Iceland. The route calls several ports around the coast of Iceland. The vessels serving on the Gray Line are the Blikur and Lomur.

The Green Line offers weekly services from Iceland to the east coast of the United States, Nova Scotia and Newfoundland and Labrador and then back to Iceland. The Selfoss, Skógafoss and Pantonio serve on the Green Line.

The Orange Line offers weekly services from Murmansk in Russia, down the Norwegian coast on its way to the Netherlands, England, Scotland and then back to Norway. The vessels serving on the Orange Line are the Vidfoss, Holmfoss, Polfoss and Svartfoss.

Seven vessels serve Other Operations in the North Atlantic. Eimskip’s reefer transportation services are specially focused on transportation of frozen or chilled seafood and other perishable products in bulk, direct from port to port, in whole or partial loads. These services are carried out by the specialized reefer vessels Langfoss, Stigfoss and Nordvåg. Eimskip offers specialized transport for bulk cargo in whole loads or by the needs of the shipper and the consignee each time. The vessel Saxum is used in bulk transport. Finally, the ferry Herjólfur offers regular services between the Westman Islands, off the south coast of Iceland, and Iceland’s mainland, and the ferries Baldur and Særún serve on the west coast of Iceland.

SAILING SYSTEM IN THE NORTH ATLANTIC

VESSEL FLEET

Eimskip currently operates 22 vessels in the North Atlantic, of which twelve are own vessels and ten are chartered. 15 of the vessels are used in scheduled liner services on six different sailing routes, thereof 11 container vessels and four reefer vessels. In addition, three reefer vessels offer spot services, one is in bulk services and three are ferries operated in Iceland. The vessels are highly competitive in terms of their size, cranes, reefer plugs, low draft and maneuvering capabilities to enter narrow ports.

The Company sold in 2017 the 25 year old, 724 TEU vessel Brúarfoss and purchased the 698 TEU vessel Sophia, built in 2008, and renamed it Selfoss.

Eimskip and Royal Arctic Line, the national carrier of Greenland, signed in January 2017 a cooperation agreement regarding potential sharing of capacity. The potential cooperation is subject to confirmation from the Icelandic Competition Authority. A contract was signed with CSTC and Guangzhou Wenchong Shipyard Co., Ltd. in China on building two 2,150 TEU ice class Polar Code container vessels for Eimskip, with expected delivery in the middle of 2019. The vessels are built in line with environmental standards and designed to be fuel-efficient.

VESSEL FLEET

Godafoss

Own VesselDettifoss

Own VesselLagarfoss

Own VesselBakkafoss

Chartered VesselPollux

Chartered VesselBlikur

Chartered VesselLomur

Chartered VesselSelfoss

Own VesselSkógafoss

Chartered VesselPantonio

Chartered VesselVidfoss

Own VesselHolmfoss

Own VesselPolfoss

Own VesselSvartfoss

Own VesselStigfoss

Own VesselLangfoss

Own VesselBaldur

Own VesselSærún

Own VesselOPERATIONS AND OPERATING ASSETS

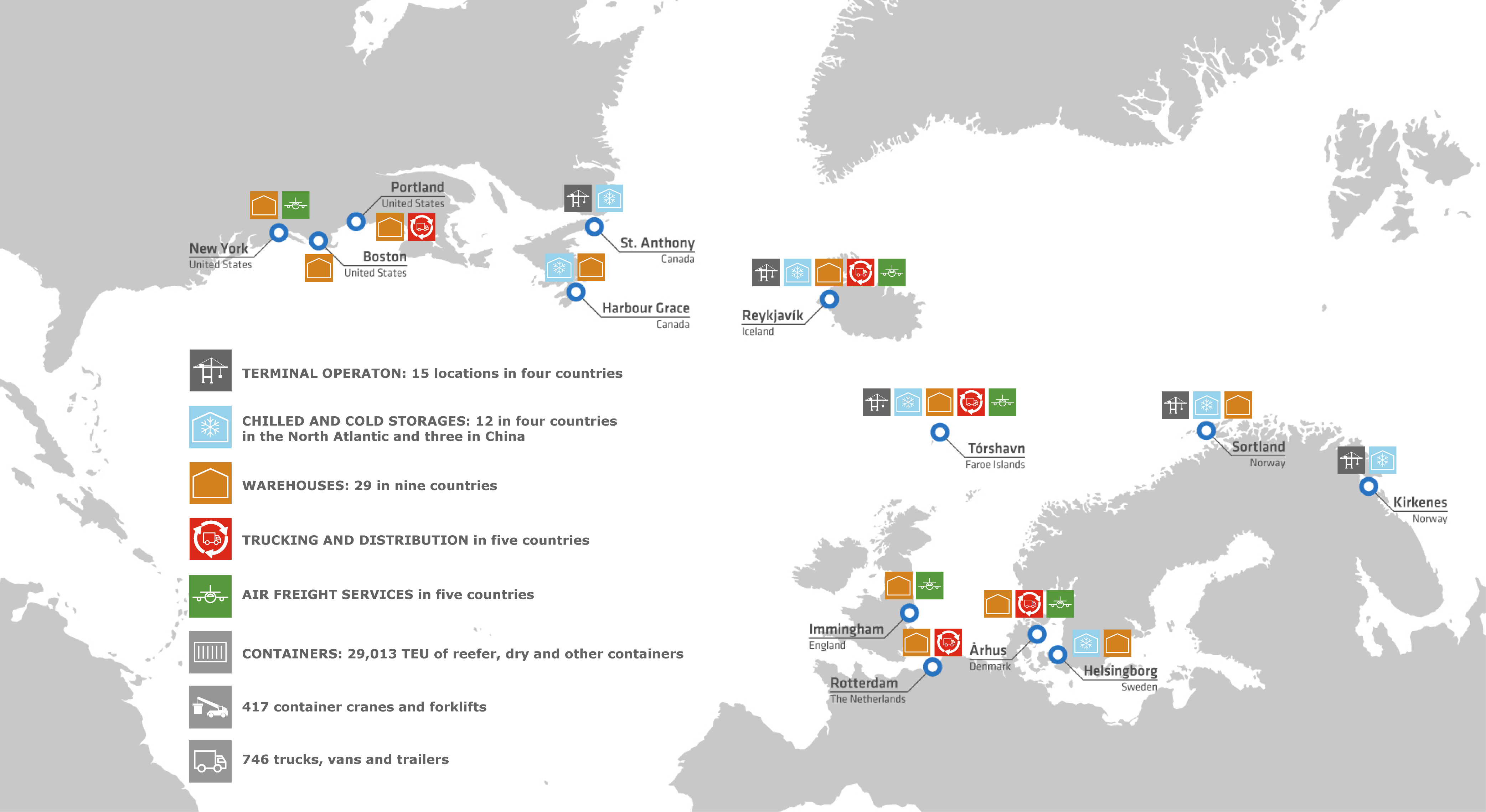

The Company operates terminals in 15 locations in four countries: eight in Iceland, three in the Faroe Islands and two each in Norway and Newfoundland and Labrador. Eimskip owns or operates 15 chilled and cold storage facilities in five countries: six in Iceland, three in China and two in each of the Faroe Islands, Norway and Newfoundland and Labrador. Eimskip also operates 29 warehouses for dry cargo in nine countries: 14 in Iceland, five in USA, three in the Faroe Islands, two in the UK and one each in Norway, Sweden, Denmark, the Netherlands and Vietnam.

The Company’s container fleet currently consists of around 29,000 TEU Trucking and distribution services are operated in Iceland, the Faroe Islands, Denmark, the Netherlands and USA. The Company operates 417 container cranes and forklifts and 746 trucks, vans and trailers.

OPERATIONS AND OPERATING ASSETS

SERVICES

Eimskip has a strong position in the Icelandic market, a fact which further motivates it to be the market leader in offering excellent services. Having a broad customer base embracing a range of different needs, the Company must always come up with solutions that can serve the mass but at the same time remaining flexible and innovative as regards tailor-made solutions.

The need to provide fast and reliable international services has been the main requirement in recent years. Every link in the transportation chain has to work flawlessly in order for the Company’s front-line employees to be able to provide outstanding services. Eimskip’s Customer Relations Management (CRM) system further enables its employees to know the customer needs. The ever-increasing pace of modern commerce demands constant adaptation to new technology and solutions to improve services further.

One of Eimskip’s Strategic Priorities in 2018 is IMPROVED IT SOLUTIONS AND IT INNOVATION, where the focus is on improving IT solutions and integrating common platforms across the Company.

The Company’s online service web for customers, ePORT, is constantly being developed. The ePORT enables customers to access invoices and necessary documents online, monitor their orders and call up a simple overview of their transport activities.

Eimskip’s service portfolio also includes the eBOX, a clear and simple, user-friendly solution for smaller shipments from Europe and North America to Iceland. Through the eBOX, customers themselves can calculate the price of transportation door-to-door on the web and the Company’s transportation system makes sure that the shipment arrives in Iceland by the first available vessel.

FORWARDING SERVICES

Eimskip is a niche player in forwarding services. The forwarding services are a network of the Company’s own offices and associates worldwide, offering a full range of transportation and logistics services. They include international reefer forwarding and dry cargo forwarding. The main emphasis has been on reefer forwarding, but dry cargo forwarding has been growing in recent years.

Forwarding services are transportation solutions that are outside the Company’s own operating system; nevertheless, they and the liner services support each other. The international forwarding market is diverse and very competitive, with many companies offering forwarding services. Eimskip is following its customers in their globalization by creating a service network in cooperation with various transportation companies all over the world. This service network is constantly evolving and attracting new customers. Eimskip has built valuable relationships and acquired extensive knowhow in the reefer forwarding trade over the years, both through its other operations and through acquisitions of specialized forwarding companies. The Company focuses on selling forwarding services by utilizing its global network of own offices, associates and international deep-sea lines, and is specialized in transportation of temperature-controlled cargo, where seafood products play an important role. The Company also offers forwarding of dry cargo through various logistics solutions worldwide.

Eimskip has been expanding its logistics network in Asia. It has since 2014 been a 30% partner in a joint venture with the Port Authority in Qingdao, China, operating a 50,000-ton cold storage facility in Qingdao. The port authority’s selection of Eimskip as a partner is an important factor in strengthening the facility’s operation and creating new opportunities.

KEY STATISTICS

Eimskip started its forwarding services in Asia by opening an office in Qingdao, China, in 2004, starting out with 4,000 TEU. The Company currently operates seven offices in Asia. For comparison, the forwarding services of the Group handled about 217,500 TEU in 2017.

Cargo volume in international forwarding services is dependent on seaborne perishable reefer cargoes in which fish products play the most important role. The volume in reefer forwarding is more stable than in dry cargo forwarding due to reefer cargo being less dependent on economic fluctuations, since consumption of food products is usually more stable than other products. Other perishable cargoes are meat, fruit and vegetables.

Forwarding services had a strong year in 2017. Revenue amounted to EUR 225.6 million, up by 68.8% from the previous year. EBITDA from the forwarding services was EUR 17.7 million, was up by EUR 6.6 million or 60.1% from 2016. Forwarding services accounted for 34.0% of the Company’s revenue in 2017 and 30.9% of its EBITDA. These ratios have grown compared to the previous year, mainly due to the recently acquired forwarding companies and organic growth.

Transported volume in Eimskip’s forwarding services in 2017, including reefer forwarding and dry cargo forwarding, increased by 41.2% from the previous year. Of the growth, 29.2% came from the recently acquired forwarding companies and 12.0% was organic growth.

As shown on the graph below on the left, transported volume in the Company’s forwarding services has gradually been increasing in recent years. The compound annual growth rate (CAGR) for the years 2013 to 2017 was 15.8%. The volume index on the right axis is based on the 2010 volume as 100. The graph below on the right shows that 76% forwarding services volume is reefer cargo.

FORWARDING SERVICES VOLUME

Changes from previous year

FORWARDING SERVICES VOLUME 2017

Reefer and dry cargo forwarding

GLOBAL NETWORK

Eimskip’s global network currently consists of about 1,850 employees in 63 own offices in 20 countries in Europe, America, Asia and Africa and a worldwide network of associates.

GLOBAL NETWORK

NEW FORWARDING COMPANIES

EXTRACO, MARECO AND SHIP-LOG

Eimskip acquired 90% of the specialized forwarding company Extraco in Rotterdam in the Netherlands in October 2016.

In January 2017, Eimskip announced the acquisition of an 80% share in Mareco, a specialized reefer logistics company, with offices in Antwerp, Belgium and Sao Paulo, Brazil.

The Company acquired in June 2017 a 75% share in the specialized forwarding company SHIP-LOG, with offices in Århus, Denmark and Bangkok, Thailand.

Annual revenue of the three companies amounts to approximately EUR 85 million and their EBITDA margin is about 6-8%. These three accretive acquisitions are strategic and each has a clear niche and provides additional benefits to the Company’s existing forwarding services. Each forwarding company brings specialized expertise to Eimskip’s forwarding services and best practices can be shared. These asset-light companies generate higher return on capital and add a great balance to the Group by geographically diversifying revenues and EBITDA.

One of the Company’s Strategic Priorities 2018 is TEAMWORK AND SYNERGIES, where the focus is on integration of Eimskip’s global team of employees, on synergies between the different divisions and companies within the Group and on integration of new Group companies to ensure maximized synergy.

Operational Excellence

During the year 2017, the Company focused on further improving its operational processes and on defining its process landscape.

It is important for Eimskip to deliver excellence in transportation solutions and services in a consistent and efficient manner. The customer experience is the end-to-end process and consequently the Company needs to standardize further and improve efficiency of its processes. The Company will continue to focus on the end-to-end processes and one of its Strategic Priorities for 2018 is BUSINESS PROCESSES AND KPIs, which focuses on improving the Company’s processes and Key Performance Indicators.

Another important factor under operational excellence is to secure resources in the best and most efficient way. In 2017, the Company worked actively on further improving its procurement processes. The work will continue in 2018 with the Strategic Priority PROCUREMENT AND BETTER UTILIZATION OF RESOURCES, which focuses on implementing strategic procurement processes to reduce costs and improve processes to reach operational excellence.